After the worst bond market in history, what can we expect going forward? Looking at the Bloomberg Aggregate Bond Index at the end of the second quarter, the total return for bonds over the past five years rounds to zero. Five years of no return where historic price declines offset five years of yield. This has been a terrible experience for bond investors, but these moves are in the rearview mirror. Bonds should help portfolios from here, whether it is soft landing or recession for the economy, and should cushion future periods of stock market turbulence.

The Fed has started the next easing cycle, cutting rates by half a percent in September. The Bloomberg Aggregate Bond Index advanced 5% in the third quarter, anticipating the well telegraphed change in Fed policy. Very interestingly, the yield curve normalized – the yield on the 2 Year Treasury is now back below the yield on the 10 Year Treasury. Investors in money markets and CDs may need to find a new place to park assets (we have some great ideas, just ask our Wealth Managers).

As we have been saying for well over a year, our base case going forward is a soft landing, with the economy cooling enough to bring inflation down but still avoiding recession. We expect the Fed to continue to lower short-term rates through next year, but longer-term yields should level off or even go higher from here, as the yield curve steepens if the economy can keep its head above water. A simple, rule-of-thumb model we use for roughly calculating where 10 Year Treasury yields should be is expected inflation plus expected GDP growth. Expectations of 2% to 2.5% for both inflation and growth would imply 4% to 5% 10 Year Treasury yield. At the current yield of 3.75%, the 10 Year is actually a little low, and this probably reflects downward bias of inflation and growth expectations and a little exuberance for the start of the rate cut cycle. Do not expect lower bond yields from here unless there is a recession. This means that, in the soft landing scenario, you should be a buyer of bonds based on yield levels and not for expectations of price increases from here (bond prices move inverse to yields and decline when yields rise and vice versa).

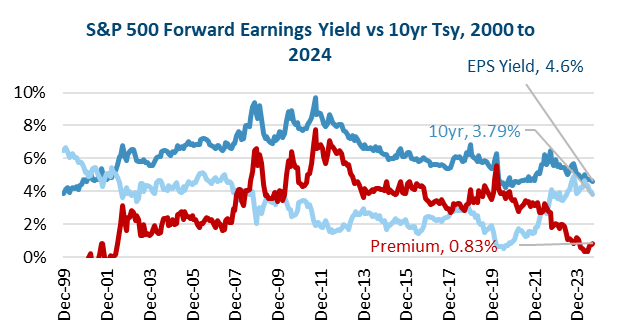

Chart 1

With some of the more attractive yields in two decades for investment grade bonds, investors are now getting reasonably compensated, especially relative to the earnings yield of the S&P 500, as seen in Chart 1. The post pandemic inflation scare period was unique in that both stocks and bonds declined, a phenomenon that we wrote plenty about. But these days, with higher yields to absorb price moves and inflation subsiding, we should expect a return of normal behavior between stocks and bonds, in that bonds should help when stocks experience a panic. In fact, this was the case during the brief summer correction in stocks when market threw a tantrum after some mildly weak economic data. The S&P 500 declined 8.5%, while the Aggregate Bond index rallied over 2% from 7/16 to 8/5 (and bonds are currently at their high for the year). If the economy were to head toward recession (not the base case scenario), then it would be reasonable to expect more of this – stocks down and bonds up.

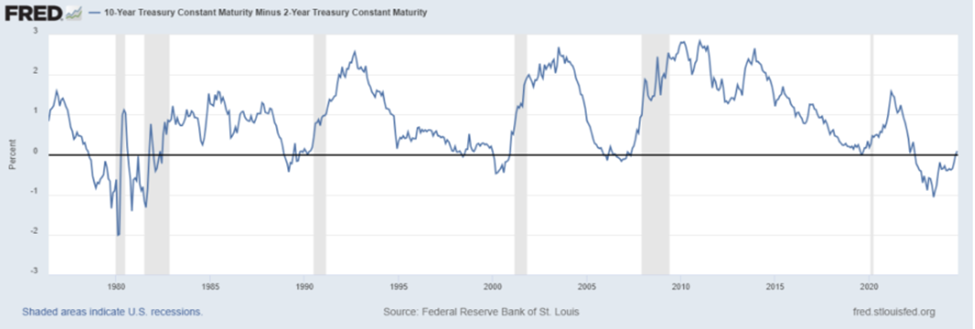

High quality bonds should do well and cushion portfolios in the case of recession as a flight to quality and as expectations for lower yields in the future fuel price advances for bonds. An inverted yield curve has been a fairly accurate warning sign of a future recession because it is the bond market expecting lower yields in the future, most likely in response to recession. Now that the yield curve is normalized, should we all take a victory lap and stop worrying about recession? Absolutely not – check out Chart 2 below from the St. Louis Fed website. This charts the difference between the 10 Year and the 2 Year yield. When the line is below zero, the yield curve is inverted. The shadowed regions indicate recession. In every recession since 1990, the yield curve started to normalize (rose above zero on the chart) before recession finally hit. While recession is not our base case expectation, it is the second most likely scenario behind a soft landing, and bonds would help portfolios in this scenario.

Chart 2

So, both the soft landing scenario and the recession scenario are good environments for bonds going forward. The scenario where bonds continue to do poorly would be a resurgence of inflation. Fortunately, this is the least likely scenario at this point. That said, if inflation were to reignite, then investors would have even higher yields to take advantage of. Do not let the historically bad returns for bonds over the past five years scare you away from allocating to the asset class. Consider it instead a potentially solid set up for fixed income going forward. Grimes & Company has compelling bond investment strategies that could offer unique opportunity in this uncertain economic environment.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.