Inflation is everywhere you look and seems less of a temporary phenomenon after the October Consumer Price Index (CPI) report changed the narrative of the markets.

CPI showed a 6.2% year-over-year increase, substantially above projections, and the highest level since 1990. The Fed and leading economists have been assuring markets that these price increases are transitory, and that notion is now being widely challenged. Yet, an objective perspective must allow for a normalization of supply chain bottlenecks, and while there are signs that the worst has passed, some forms of inflation may be more persistent than the Fed is currently anticipating.

What may not be transitory is increased labor costs, which is something we have been writing about for a while now, including “What is Going on With Jobs?“ earlier this year. With record job vacancies, every industry is having difficulty filling positions. At Grimes & Company, we added five team members since the COVID outbreak, and are looking for four more. Where are all the workers? COVID was a catalyst for many to retire, exiting the work force completely. Many others have been hesitant to return to work, perhaps accustomed to the stay-at-home lifestyle, still cautious about the virus, or having difficulty finding childcare. A booming economy has most industries humming along and looking for employees to support growth, which explains the record job openings (over 10 million) in America. Workers are moving up the pay scale more easily than ever before to find better pay and, perhaps more importantly, a more consistent salaried income stream with better benefits.

In the long run, and from a humanitarian perspective, this is a good thing. While many Americans have benefited from strong stock markets, rising values of their real estate, and cheap borrowing costs, the majority have not. To have families supported by lower paying jobs that have not benefitted from the “easy money” earn more may help the problems described in my blog earlier this year “Prolonged Extreme Monetary Stimulus Widens the Wealth Gap“. However, wage inflation is real, and it could be more persistent than many think.

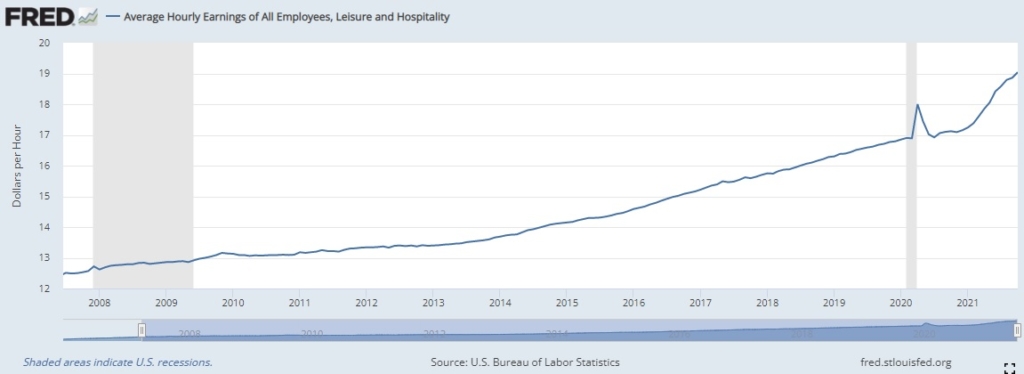

(Source: FRED, St Louis Fed; Board of Governors)

We all have stories of long waits, short staff, spotty service, and even intermittent closures of our favorite restaurants around the country. The Leisure and Hospitality industry has more job openings than any other industry and, as the chart (courtesy of the St. Louis FRED website) shows, pay levels are soaring. Besides the COVID distortion, which led to a temporary spike in wages since the lowest earners were laid off or otherwise collecting enhanced unemployment benefits, the wages have been moving steadily higher since 2013. Wage growth has accelerated parabolically and advanced more than 10% in 2021 alone. To lure employees back to work, the cost will need to go higher in virtually all industries and much of these costs will be passed to consumers – there’s your persistent inflation. Don’t be surprised when dinner at your favorite restaurant is twice as pricey than pre-COVID.

Scaling this analogy up to the full economy, the wage growth data in the already closely followed unemployment report will continue to be closely followed over the coming months, as analysts look for clues that the Fed may have to accelerate its policy plans.

Important Disclosure Information:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Board of Governors (US), NASDAQ, Bloomberg, Orion, Worldometer.info, and FactSet. Not a substitute for tax or legal advice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.