The bond market is incredibly vast and many times the size of the stock market. Treasury bonds are considered riskless and have historically buffered stock portfolios nicely during market declines when investors seek a safe haven – Treasury bonds generally go up in value when markets decline.

The biggest factor for Treasury pricing is interest rates, and as interest rates decline, existing bonds with higher fixed interest payments become more valuable (go up in price) and vice versa. Credit markets can behave very differently since these bonds carry credit risk, and unlike the U.S. Treasury they could default. Like Treasuries, corporate bonds are influenced by interest rates, but they are also influenced by the state of the economy. In a healthy economy the likelihood of default is low, and in a recession the likelihood of a default is higher, and for these reasons they tend to correlate more with stocks than Treasuries, especially as you move down the quality spectrum to more risky borrowers. Risky borrowers pay much higher interest rates than Treasuries, but during times of market stress, High Yield corporate bonds usually decline in price along with stocks, reducing their usefulness as a diversifier or hedge to the portfolio. A recent example, during the first quarter of this year in the peak of the pandemic market mayhem, 10 year Treasuries advanced 10%, while the ML High Yield index declined -13%.

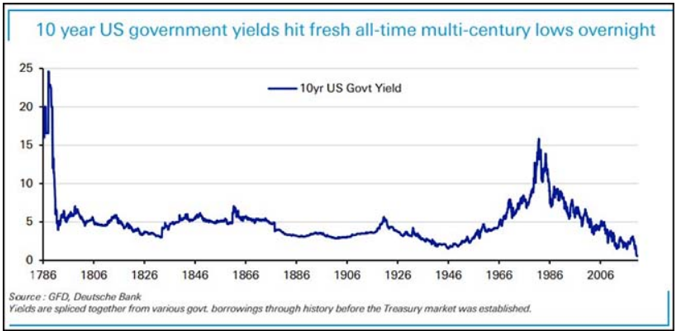

However, Treasuries now have the lowest yields in history by a large margin. Consider the chart below from Deutsche Bank, and you can see we are well below yields experienced during other difficult times when, as is the case these days, the Central Bank kept borrowing costs artificially low, like after the Civil War and even post WW2. As of this writing, the 10 year Treasury yields 0.51%, which is unfathomably low. All things equal this is a fantastic time to be a borrower (time to refinance the mortgage if you have not already), but probably the worst time in history to be a lender. Investors cannot come close to covering the rate of inflation (negative real yields), and can earn four times as much in dividends from an S&P 500 or Dow Jones Industrial Average index fund. Money markets are yielding a number that rounds to zero, and this situation is likely to be the case for the foreseeable future. The Wall Street Journal reported that Fed policy is likely to abandon the practice of pre-emptively raising interest rates to curb inflation, instead opting to allow periods of inflation exceeding the target 2% level. Other than cushioning the portfolio during market shocks, we see little logic in adding Treasury bonds to portfolios.

The major bond indices have performed incredibly well this year, benefiting from the flight to quality and historically low rates. The Bloomberg Barclays Aggregate (74% of which is AAA rated and mostly government debt) has advanced almost 8% for the year, while the Bloomberg High Yield Index is still negative. But one must ask “where do we go from here?” Recently, investment managers looking to generate income have found it impossible to keep pace with the Aggregate Bond index. However, unless rates go negative, a highly unlikely but possible event, then little return can be expected from here. On the other side of the spectrum, high yield bond funds are generating yields over 5.5% but carry risk and higher volatility. It seems that the Aggregate Bond index may have already enjoyed its best days relative to other areas of the bond market that still offer some opportunity.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Grimes & Company, Inc. (“Grimes”), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Grimes is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. Please remember that it remains your responsibility to advise Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request.