We have been hearing about the impending doom of the national debt crisis seemingly forever, at least since the US came off the gold standard in 1971 and started running deficits. Yet year after year, the bill never comes, and problems resulting from stunning amounts of debt never materialize, as the economy powers forward and the markets shake off worry. National debt is not something that I have worried about much throughout my career, because it has always been a problem for the distant future that just did not factor into the 12-18 month look forward that we focus on for portfolios. However, similar to other problems that once seemed for the distant future, like climate change, the incremental math on this problem has shifted, pulling tomorrow’s problems into today.

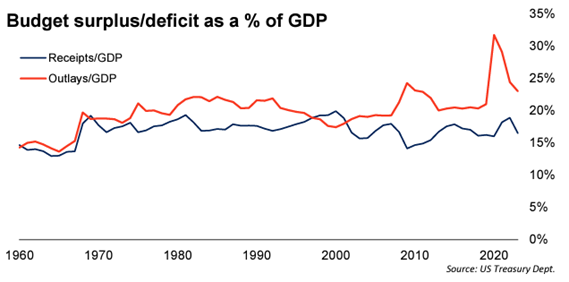

The below chart shows receipts or “money in” for the government (taxes) in blue and outlays or “money out” (spending) in red. The difference between the two is the deficit or surplus. As you can see, with the exception of 1998 to 2001, the US has consistently been in a deficit. It is normal, and necessary, to run big deficits during stress periods like war and recession, and indeed you can see the spikes resulting from the Global Financial Crisis in 2008 and the pandemic in 2020, when massive spending and stimulus were needed to stave off severe economic crisis.

Chart 1

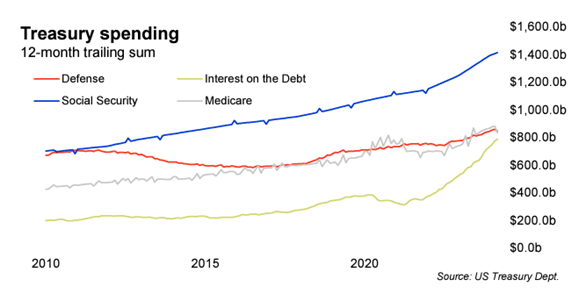

Running a deficit that is more or less in line with GDP growth may not be ideal, but it is generally sustainable for a large country like the US. However, the deficit today is greater than 5%, or twice the long-term average GDP growth, during a time of economic strength and relative stability (not crisis), and this is certainly not sustainable. Moreso, the cost of this debt is the highest it has been since 2007, before the Global Financial Crisis (Ten-Year Treasury yield). As the chart below illustrates, the big increases in spending are Social Security and interest on debt. The interest on debt is double the pre-pandemic high and rising faster each year. This is the crux of the problem – the size of the deficit to GDP and the cost of debt. Both of those things are trending rapidly in the wrong direction, and this is why I fear that the time to worry about debt may be approaching.

Chart 2

Debt crisis will likely manifest when Treasury bond yields move to higher levels because of failed auctions, when buyers demand more of a default premium. When foreign governments and domestic investors have had enough and demand more yield, the government will have to listen. Politicians will not act until they become worried about their jobs for not doing so, or because they are elected on a platform of reasonable fiscal responsibility. The longer it takes for that to happen, the more difficult it will be to restore balance and confidence. The larger the deficit and the higher the interest rate, the tougher the medicine, which will likely include both tax increases and fewer entitlements, all of which will be unpleasant.

Navigating this difficult period, when it finally comes, will be challenging and without precedent. Using strategies that can manage risk beyond diversification alone could help. Trying to predict how markets and governments will react to debt crisis will be impossible, but having a strategy that measures and reacts to markets could provide a smoother ride and better investment experience.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.