As retirees approach the age where Required Minimum Distributions (RMDs) from their IRAs kick in, many find themselves facing the same dilemma: “What should I do with any extra funds that exceed my living expenses?” This dilemma can be particularly challenging for those who wish to manage their tax liability while still supporting their charitable goals. The good news is there’s a savvy way to support your favorite causes while keeping your taxable income in check—through something called a Qualified Charitable Distribution (QCD). Let’s explore how this approach can benefit you and the causes you care about.

What are Required Minimum Distributions (RMDs) and when do I have to take them?

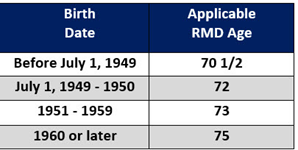

RMDs are mandatory withdrawals that individuals must begin taking from their tax-deferred retirement accounts at a certain age as defined by the IRS (See chart). The amount you must withdraw is based on IRS calculations tied to your life expectancy and the value of your retirement account as of the prior year-end.

What are QCDs? Is there an annual limit?

A Qualified Charitable Distribution (QCD) is a method of charitable giving for individuals aged 70½ or older to make charitable donations directly from their IRA. By transferring up to $105,000 annually (2024, indexed for inflation) directly to a qualified charity, the amount counts toward clients RMD but is not included in their taxable income. It is important to wait until you are officially age 70½ before making the charitable gift so that is qualifies as a QCD.

What is my Adjusted Gross Income?

Your AGI is essentially your gross income (all the money you make from wages, dividends, interest, rental properties, and more) minus certain deductions. You’ll find your AGI on line 11 of your IRS Form 1040—it’s a number worth knowing, especially when it comes to tax planning.

Why Does This Matter? The Tax Impact of QCDs:

Keeping your Adjusted Gross Income (AGI) in check has a ripple effect on your finances. For instance, let’s say you are Married Filing Jointly and have an AGI of $200,000. If your RMD pushes that income up further, you could jump from a 22% to a 24% tax bracket and face higher Medicare premiums due to Income-Related Monthly Adjustment Amount (IRMAA). By using a QCD, you can keep your AGI steady while still making a charitable donation—meaning you get to support your favorite causes and keep your taxable income from going higher.

What if I take distribution then donate to charity?

If you take your RMD and then donate cash, the distribution will be added to your taxable income. Even though you might get a charitable deduction if you itemize, you’re still paying taxes on the RMD itself and the RMD amount will be added to your AGI. This is why doing a QCD directly from your IRA to a qualified charity is typically more beneficial from a tax perspective.

Can I take a QCD to Donor Advised Fund (DAF)?

No, you can’t direct a QCD to a Donor-Advised Fund (DAF). The IRS requires that QCDs be made directly to qualified charities not intermediary organizations like DAFs. To qualify for the tax benefits of a QCD, the donation must go directly from the IRA to a charitable organization that is classified as a public charity or other IRS-recognized charity. While DAFs offer flexibility for your charitable giving, they don’t qualify for the same tax benefits as a QCD.

Are QCDs reported on my Form 1099?

No, unfortunately you will still receive a Form 1099 showing your total IRA distributions for tax reporting even if some of the distribution was a QCD. It is important to keep track of your QCDs and report them to your Tax Preparer as they need to be manually deducted from the total distribution amount on the Form 1099.

Conclusion

Maximizing charitable giving while managing your RMDs doesn’t have to be complicated. By leveraging the QCD strategy, you can support your favorite causes and lower your tax burden. At Grimes, our advisors are here to help you navigate the complexities of RMDs and charitable giving. We’ll work with you to ensure your financial and philanthropic goals are aligned, allowing you to make the most of your retirement assets. As always you should consult with your Tax Advisor prior to making any charitable donations.

*Grimes & Company would like to thank Lucy McHugh, one of our Summer 2024 interns, for her assistance in researching and helping to write this blog.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.