This week the latest inflation reports were posted, and inflation at both the consumer and producer levels cooled in May. While this is good for Wall Street, many on “Main Street” are just not buying that assessment. In fact, during his press conference on June 12, Federal Reserve Chairman Powell was asked: “What’s your message to Americans who are seeing encouraging economic data, but don’t feel good about this economy?” To which Powell responded with the following: “I don’t think anyone knows, has a definitive answer why people are not as happy about the economy as they might be. And we don’t tell people how they should think or feel about the economy. That’s not our job. We, you know, people experience what they experience… We had a period of high inflation. Inflation has come down really significantly and we’re doing everything we can to, you know, to bring that inflationary episode fully to a halt and fully restore price stability.”

This blog addresses that sentiment.

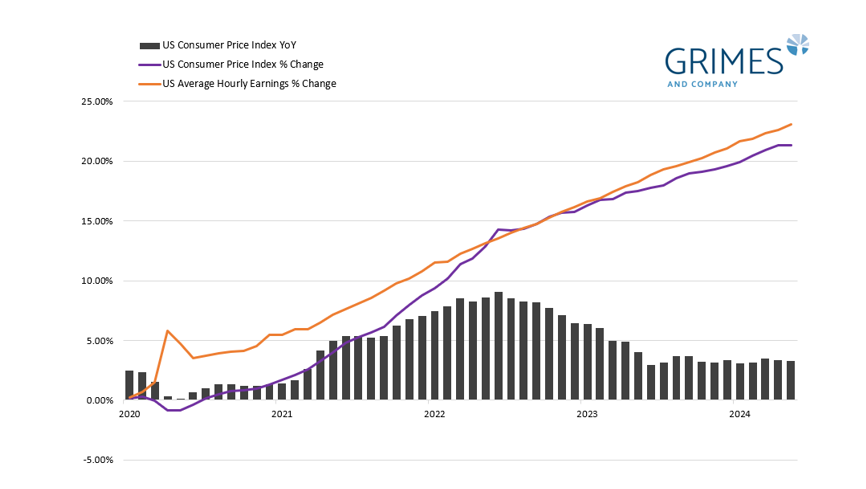

So often when talking with clients I get the inflation question that goes something like this: “Why does the news say inflation is coming down, because I just don’t see it as everything is still so expensive?”. Perhaps it is that many people, maybe even subconsciously, tend to think of inflation like the price of gas at the pump, in that sometimes gas prices are high, but eventually come down to a more reasonable price. Inflation does not work that way. It is a one-way street, a potentially dangerous animal that moves in one direction (generally) – up. The rare periods of price declines, or deflation, only occur briefly during serious and prolonged recessions. Thus, investors confuse price level with price change (which is what inflation is). Inflation these days, as measured by the Consumer Price Index (CPI), is now advancing more slowly, about 3% annualized, than in 2022, when 9% price increases were recorded (see black bars in chart that show year-over-year inflation). The Fed is targeting 2% annualized inflation. While things are a lot more expensive than they were before the pandemic, that is because of inflation past, not inflation present.

Chart 1

Chart 1 illustrates this point well and shows the cumulative increase in CPI since the beginning of 2020 (purple line). Prices are up over 20%! This means that you are paying, on average, 20% more for goods and services. Life is 20% more expensive to live. Unfortunately, this is not going to change. Those price increases are now built in forever. A family of four is probably not going out to a sit-down dinner for under $100 again, and the babysitter is getting a lot more than a twenty dollar-bill if mom and dad go out without the kids. As you can see from the chart, prices are generally always rising. You can also see that the purple line was rising parabolically while the black bars were stacking up high year-over-year increases in inflation during 2021 and 2022 as the combination of supply chain disruptions and the Russia induced oil spike caused a major surge, but that advance has since “slowed down”, and this is what economists mean by inflation slowing. Prices are still advancing, but at a lower pace, and the target is to have this line “only” go up 2% a year – but it still goes up and does not come back. Keep in mind that even at the Fed’s target of 2%, prices still rise over 20% per decade.

The related question we often get is that if prices have risen so much, why is the consumer still spending? As you can see from the orange Average Hourly Earnings line on the chart, wages are also rising. Wages are also a one-way street. Employers do not generally meet with their employees to tell them that they did a great job this year, but next year their earnings are going down. As you can see from the chart, Average Hourly Earnings have advanced even more than inflation. This is good news and bad news. They good news is that, on average, people are keeping their standard of living and can still afford goods and services at these higher prices. The bad news is that wages, which is the cost of employees, are a key input for prices and higher wages could cause inflationary pressure in the future, which is an inflationary feedback loop.

Higher price levels are here to stay, but the question is how fast they rise from here.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.