Inflation has been the hot topic for most of 2022, with the rising price of food, gas and services catching everyone’s attention. While inflation on expenses has been painful, it comes with some benefits in the form of inflation-adjusted figures across retirement plan contributions, tax brackets and more.

How Are Retirement Contribution Limits Changing in 2023?

Many components of the tax code are adjusted by the IRS annually for inflation. With inflation at a multi-decade high, many of these figures received sizeable adjustments for 2023. The employee contribution limit for 401k and similar employer plans will be raised to $22,500 (from $20,500 in 2022), with a $7,500 (from $6,500) catch-up contribution allowable for employees age 50 and older in 2023. For SIMPLE plans, the maximum contribution for 2023 is increasing to $15,500, with a $3,500 catch-up contribution for employees age 50 and older. These figures are increased from $14,000 and $3,000, respectively, in 2022.

For those who are self-employed and contributing to a Solo 401k or SEP IRA or those with employer plans which allow for after-tax contributions, the plan contribution limit, including employer and employee contributions, will be $66,000 in 2023 (up from $61,000). For workers over age 50, the additional $7,500 catch up contribution can be made on top of the $66,000 maximum, for a total potential 2023 retirement plan contribution of $73,500.

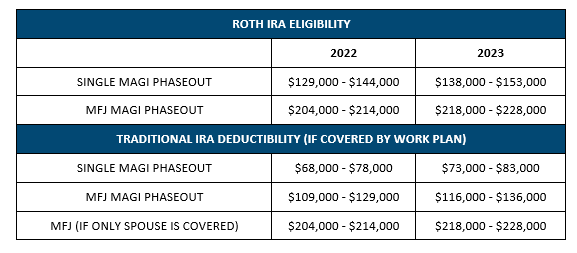

For those making contributions to Individual Retirement Accounts (IRAs), the contribution limit is rising to $6,500 (from $6,000) in 2023. The catch-up contribution for IRA accounts will remain at $1,000, as this amount is not typically adjusted for inflation. In addition, more workers may find that they are now eligible to make Roth IRA contributions or deduct the contribution to their Traditional IRA as the income thresholds are also rising. Below is a summary of the 2022 vs. 2023 IRA contribution limits:

As a reminder, if you earn too much to receive a deduction for your IRA contribution, you can always make a non-deductible IRA contribution, but you will want to make sure that any non-deductible IRA contributions are tracked on Form 8606 of your tax return. You may also be able to convert any non-deductible IRA contributions to a Roth IRA using the backdoor Roth IRA strategy. Note that this strategy works best when you do not have any existing Traditional IRA funds.

Will My Tax Bracket Change in 2023?

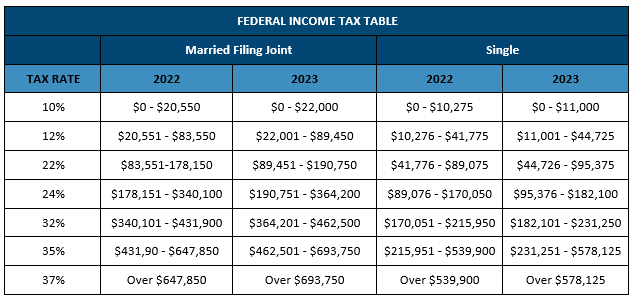

In addition to the various retirement plan contribution adjustments, the IRS has announced that the income thresholds and standard deduction amounts will be increasing for 2023 thanks to high inflation. Below is a summary of the 2023 vs. 2022 income tax thresholds for Married Filing Joint and Single tax filers:

While the tax rates themselves are not changing in 2023, the income thresholds shifting higher may mean lower effective tax rates for many taxpayers. The standard deduction is also rising to $27,700 for married couples and $13,850 for single taxpayers in 2023.

Are the Estate and Gift Amounts Changing in 2023?

Following suit with the other 2023 inflation adjustments, the lifetime exemption for estate and gift tax is rising to $12.92 million per person next year (up from $12.06 million in 2022). Married couples will be able to shield a total of nearly $26 million from estate and gift tax beginning in 2023.

The lifetime exemption for estate and gift tax is set to revert to its pre-2018 level of $5 million, adjusted for inflation, as of January 1, 2026, when the 2017 tax cuts expire. However, Congress may act before then to determine whether to keep the tax cuts in place or let them expire.

The annual exclusion gift amount (the annual amount of money that one person may transfer to another as a gift, without incurring a gift tax or affecting the unified credit) will also increase to $17,000 per person (from $16,000) in 2023.

While many have struggled with higher inflation costing them more at the gas pump and the grocery store, in 2023 they may see the bright side of inflation. These adjustments may result in higher take home pay (because of lower tax withholding from paychecks) and larger retirement plan balances in the long term (as the increased contribution amounts have the power to significantly compound over time). As always, please reach out to your Advisor to discuss the implications of any of the tax code changes as it relates to your personal situation.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.