Cost basis refers to the original purchase price of an asset, plus any improvements. A sometimes overlooked, yet powerful, tax strategy is what is commonly referred to as a “step-up” in cost basis. Understanding and planning for basis adjustments at death could significantly reduce capital gains tax when an asset is later sold by heirs, making it a crucial tool to consider for estate planning.

Cost Basis and Step-Up/Down Basics

For investments, cost basis often denotes the original purchase price, plus reinvested dividends. The step-up in basis is a tax provision that adjusts the cost basis of an inherited asset—such as real estate, investments, or a business—to its fair market value at the time of the owner’s death. In most cases, this basis reset eliminates unrealized capital gains on the appreciation that occurred during the decedent’s lifetime, thus providing significant potential tax savings for heirs. Effectively, it’s as though the heir purchases the inherited asset for its fair market value on the date of the decedent’s death.

It’s worth noting that this cost basis adjustment is often interchangeably called a step-up, since assets generally increase in value over time. However, if an asset has lost value since purchase, the cost basis would be adjusted downward. Planning for depreciated assets during one’s lifetime is necessary to optimize use of capital losses.

Does Asset Ownership Impact Basis Adjustment?

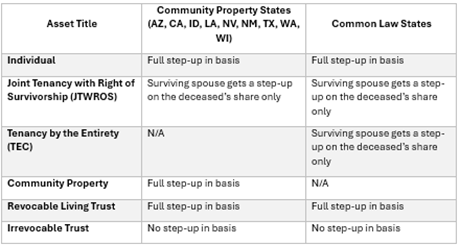

The way an asset is titled could significantly impact how the basis adjustment applies. If an asset is owned solely by one person, the entire asset receives a step-up in basis upon their death. For assets owned jointly (e.g., between spouses), the basis adjustment depends on whether the couple lives in a common law state or a community property state (as seen in Chart 1). In community property states (e.g., California, Texas), both spouses equally own any property acquired during the marriage. In these states, if one spouse dies, the entire property can receive a step-up in basis to the current market value, rather than just half of it. In contrast, if one spouse dies in a common law state, only the deceased spouse’s share of jointly owned assets receives a step-up in basis.

Chart 1

Case Study: The Smith Family

John and Mary Smith are in their late 80s and have built a successful portfolio of real estate and stocks over the years. They purchased their family home 30 years ago for $200,000, but its value has increased to $1.2 million. They also own stocks, which were purchased for $500,000, and are now worth $1.5 million, held in a taxable joint account. Their children, Emily and Jake, are the primary beneficiaries.

John and Mary incorporate a step-up in basis strategy in their estate plan by choosing not to sell or transfer their assets during their lifetime. When they pass away together, Emily and Jake inherit the family home worth $1.2 million, which becomes their stepped-up basis. Similarly, the stocks they inherit also receive a step-up in basis to $1.5 million. If Emily and Jake decide to sell the home and stocks soon after inheriting them, they could owe little-to-no capital gains tax, since the sale prices will be nearly the same as their basis. In contrast, if John and Mary had sold the assets while they were alive, they would have realized $2 million of capital gains, before any applicable exemptions.

Preserving Your Legacy with Planning

Cost basis adjustment is a valuable planning tool that allows for the cost basis of taxable assets to be adjusted to the fair market value at the time of the owner’s death, thus minimizing capital gains taxes for heirs. Beyond tax savings, this provision simplifies estate administration, eliminating the need for heirs to track original purchase prices. It also maximizes wealth transfer, especially for those with highly appreciated assets, such as real estate or stocks. However, other estate tax considerations may apply, making it essential to coordinate with your financial planner, estate attorney, and accountant.

We invite you to review with your Grimes & Company advisor how your assets are titled, consider holding appreciated assets until death, and seek professional guidance from your estate attorney and accountant if additional planning needs are required for your situation. Diligent planning today ensures your heirs inherit assets efficiently and tax-effectively, thus preserving your financial legacy.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, LLC. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.