The inclusion of Roth Conversions into a comprehensive financial plan requires the advisor to balance tax liabilities, income needs, and estate planning objectives for their clients. Recently, an advisor at Grimes & Company came across a client situation and we’ve decided to highlight how they conducted their analysis, and why they recommended a Roth Conversion.

Melissa and Jack, aged 64 and 66 respectively, will be retiring within the year and are seeking advice on optimizing their financial plan. They have a current net worth of $3.8 million, with $2.8 million liquid split between Roth IRAs, 401(k)s, Traditional IRAs and taxable brokerage accounts. After careful consideration and planning, they feel comfortable waiting to file for Social Security until age 70 to maximize their benefit.

Planning under the assumption that both Melissa and Jack will be retiring this year, we first examined their income needs prior to Social Security. Upon retirement, Jack will be filing for his pension benefit, which should account for roughly 40% of their income needs until they file for Social Security. The remaining 60% will be made up of their cash savings as well as dividends and interest from their taxable brokerage account. If needed, they will be dipping into principal from this account. From a tax perspective, they are projected to hit the 12% bracket (Married File Jointly) prior to taking Social Security and their Required Minimum Distributions. Afterwards, they will potentially push into the 24% bracket (Figure 1).

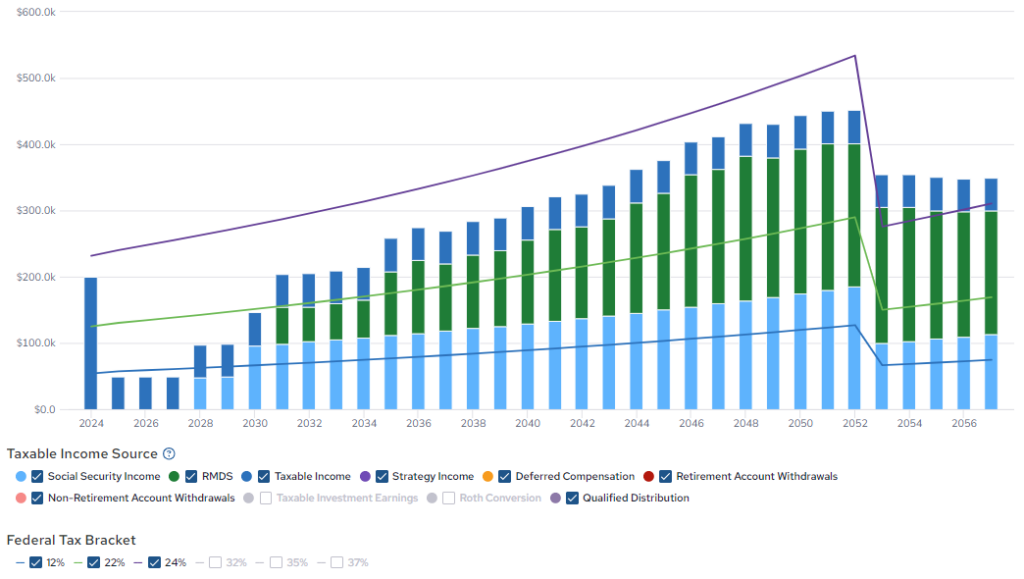

Figure 1: Income Sources and Tax Brackets Without Roth Conversion

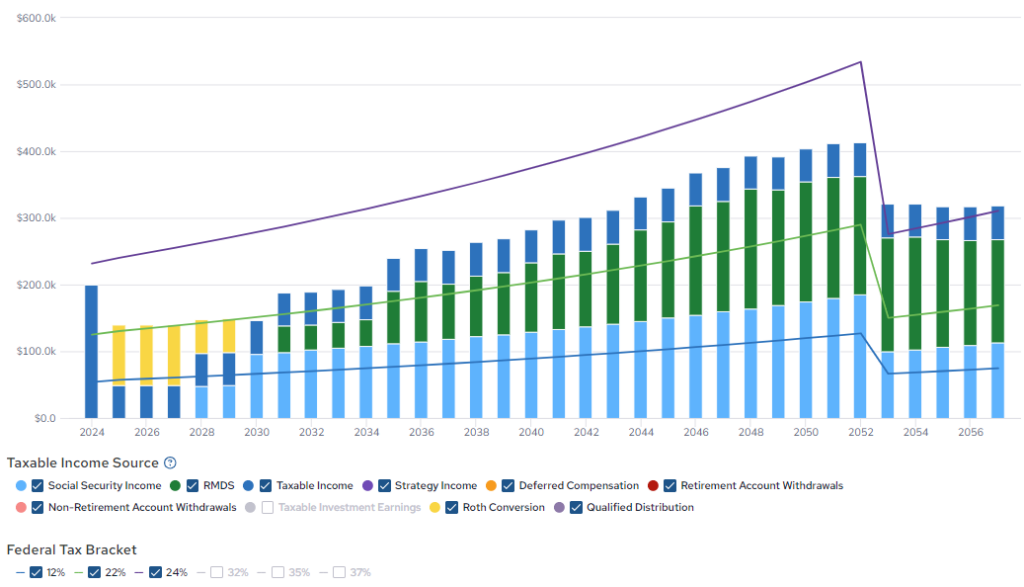

Now that we have determined their projected income will meet their expense level during the period post-retirement and pre-Social Security, we reviewed their primary long-term goal of leaving a tax-efficient legacy for their children. To achieve this, we analyzed filling out the 12% tax bracket by adding roughly a $90,000 conversion per year upon retirement until Jack files for Social Security, and an additional $50,000 per year until Melissa files for her benefit. This strategy increases their short-term tax liability since any dollar withdrawn from their tax-deferred accounts will be taxed at their earned income brackets. However, as shown in Figure 1 and Figure 2, it will significantly lower their long-term tax liability. Additionally, Roth conversions benefit future heirs by allowing them to inherit Roth accounts and receive funds distributed tax-free over a ten-year period, which is particularly advantageous if the heir is in a high tax bracket, ensuring the legacy left is tax efficient.

Figure 2: Income Sources and Tax Brackets with Roth Conversion

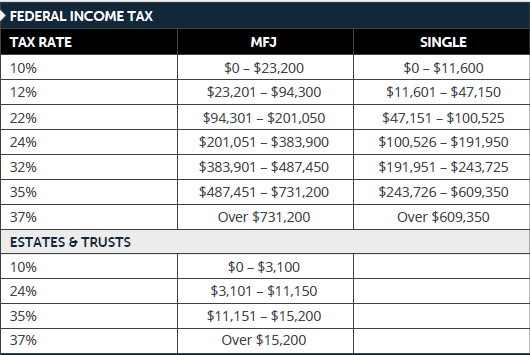

The largest unknown in this scenario is centered around market returns. Since Melissa and Jack have a sizable taxable account, from an investment perspective, we will have to monitor their realized gains and taxable dividends and interest annually to account for this variable. Additionally, we will work with their accountant to determine the exact amount of the conversion, filling up the 12% bracket without pushing into the 22% bracket (see Figure 3). This approach allows them to manage their tax burden while taking advantage of relatively low tax rates.

Figure 3: Federal Income and IRMAA Tax Brackets

In this example, both Melissa and Jack are projected to be well below the Income-Related Monthly Adjustment Amount (IRMAA) Medicare premiums for higher-income earners during their Roth Conversion years, as shown in Figure 3. It is important to note that this analysis does not take into consideration state and local taxes, as they may vary greatly among clients, but would need to be taken into consideration when considering this strategy. Additionally, when Melissa and Jack officially retire, they will need to fill out a Life-Changing Event Form (SSA-44) to have Medicare adjust their calculations, as their premiums will be based on their Modified Adjusted Gross Income (MAGI) from two years prior.

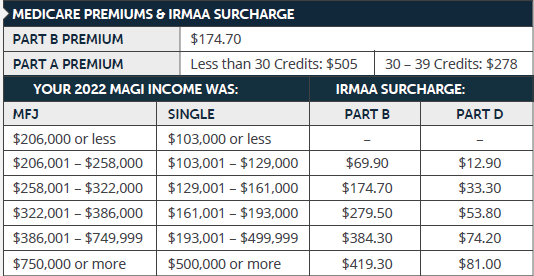

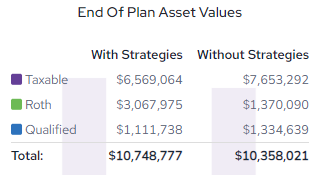

Every client’s situation is unique, and recommendations must be tailored to their individual preferences and circumstances. We highlighted this situation, as it comes up frequently, however, it isn’t the only time we recommend clients to utilize Roth Conversions. Some clients may prioritize tax efficiency, while others may value flexibility or legacy planning. In this example, Melissa and Jack were able to meet their cash flow demands post-retirement and prior to starting Social Security and Required Minimum Distributions as well as achieve their long-term goal to leave a tax-efficient legacy for their children. While their asset allocation does not change, at least in a traditional stock vs. bond sense, the distribution of their assets across taxable, tax-deferred and tax-free accounts changes drastically, per Figure 4.

Figure 4: Asset Values in 2057, by Location

Roth conversions offer significant long-term benefits, including tax-free growth and withdrawals, reduced future RMDs, and potential estate planning advantages. However, there are trade-offs to consider when recommending a Roth conversion. Assessing these trade-offs helps determine whether the benefits of a Roth conversion outweigh the costs for the client’s specific situation. In this situation, the client goals allowed us to provide a recommendation that aligned with their priorities. We encourage all clients to reach out to their advisor if this situation resonates with them or would like to determine if completing a Roth conversion is the right move for their financial picture.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.