The real economic risk for the Delta variant lies in supply chain impact from other countries where vaccines are not readily available or distributed.

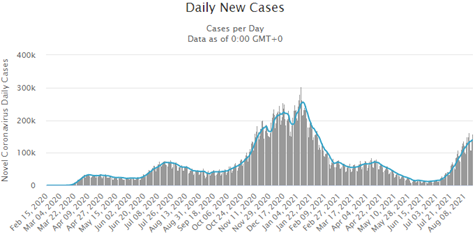

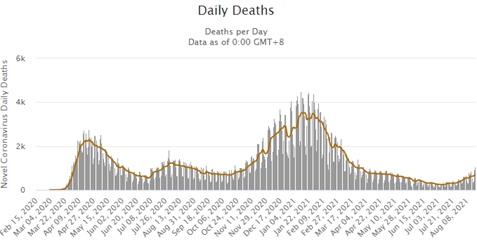

Here in the U.S. we are barraged with COVID headlines every day, but the facts show that the vaccines, for those that choose to take them, are doing their job. People are going to get sick, and there is little that we can do to prevent that, but severe cases and deaths are being almost entirely prevented with the vaccine. As you can see from the charts below (courtesy of Worldometer.info), peak cases this summer are twice as high (139,000 cases per day versus 70,000 based on 7-day average) and yet peak deaths are nearly 40% lower (703 per day versus 1222 based on 7-day average) and this is with only half of the population across the country vaccinated and a variant that is twice as transmissible.

(Source: Worldometer.info)

(Source: Worldometer.info)

On August 17th the Wall Street Journal reported a study that since January 1 there have been 16,578,509 cases of Covid-19 in the U.S. Of those there were 193,000 breakthroughs, or 1.1% of all cases, the vast majority of which are elderly or have compromised immune systems.

Boosters, break-throughs, surges, mandates – where is it all going?

While I cannot pretend to know the answers, my experience tells me that, like with most things, taking a very high-level perspective can provide some sense of clarity. This is the perspective I took when detailing my opinion that investors should be more optimistic in spring 2020 in this Barron’s Interview, Barrons.com: Kevin Grimes “Don’t Bet Against a Vaccine”. So here goes – We have a new highly transmissive and rather deadly super-flu which is a reality that we will likely be living with for a long time to come. Luckily there exists an extremely effective treatment. While vaccines do not mean that there is total immunity to the virus as a vaccinated person can still transmit the virus, could feel ill for several days, and even, in extremely rare situations, need a trip to the hospital, the likelihood of death from COVID after being vaccinated rounds to 0%. The virus tends not to target the young and the healthy who will, over time, develop a natural resistance to it even if they do not take vaccines, just as has always happened throughout history with pandemics. Remember that surviving an infection counts towards herd immunity. In short, we will need to eventually accept it as part of life. Annual shots, or boosters, are likely to become the norm, available just like flu shots have been for years, which should mitigate the risk of future variants and waning immunity.

Right now, the problem is not the domestic population; the problem is those in poorer countries that do not yet have access to vaccine. Putting the humanitarian discussion aside for a moment and strictly from a cold economic perspective, what needs to happen next is the continued global vaccine rollout to other countries to straighten supply chains and solidify global growth and consumption. Until that point it will be very difficult to estimate what realistic inflation and growth assumptions will be and therefore what central bank monetary policy should be. The global economy needs to fully open to reduce supply chain pressures before we are fully out of the woods, and that is probably months, or quarters, away. That said, it is coming, and making a portfolio decision based on short term Delta variant or sensational headlines would likely be a mistake.

Important Disclosure Information:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.