Inflation is making a comeback. The Consumer Price Index rose 4.2% in April 2021 versus April of last year, the highest level since 2008, giving the stock market an excuse to pause its 12% rally thus far this year (S&P 500).

Increased economic activity, combined with supply chain issues, has been exaggerated by year-over-year comparisons to the lockdown lows of April 2020. Much of this should have been widely expected, but it seemed to surprise the markets, as equities were volatile on the day of the CPI announcement. For most of the year, the bond market has been pricing in higher inflation, as the 10-year Treasury yield (red line in Chart 1) has risen from 0.91% to 1.65%, but is still well below the 10-year Breakeven Inflation Rate – what the market is expecting for average inflation over the next ten years (blue line Chart 1) – suggesting higher rates to come. Bonds, in general, are having a tough time, as the Bloomberg Barclays Aggregate Bond index is down 2.7% year-to-date, since historically low yields cannot cover the price changes from rising rates.

Source: FRED, Federal Reserve Board of Governors, US

For its part, the Fed is still unimpressed and insists that it is not time to even consider discussing tighter monetary policy. Chair Powell and most Governors on the speaking circuit maintain that the current rise in inflation pressure is “transitory”, a word you will hear plenty of in the financial media, meaning that these higher prices are due to temporary phenomena and not indicative of meaningful inflation. There could be plenty of truth to that. Floods and brutal weather in Texas greatly impacted multiple industries, such as upholstery for furniture (foam is a petroleum product), as parts of the energy and chemical supply chain were temporarily shut down. COVID-19 related disruptions on production and global shipping are wreaking havoc on supply chains, and nearly every industry is impacted in some way.

For example, when is the last time you looked at a car dealership lot and it seemed empty? There is a dearth of new cars because of the semiconductor shortage (there are a lot of computer chips in cars, and chips are in short supply due to demand for PCs/laptops spiking in 2020, followed by droughts in Taiwan), which is causing rental car prices to soar and leaving used car prices up 15% as a result. Combine this with a 9% surge in airfare prices as travel spending spikes before airlines can react, and you have a serious impact on the inflation number from the transportation sector. FHN Financial estimates that if transportation had risen the same 0.7% that it did in March, rather than the actual increase of 3.97%, then the core CPI increase would have been 0.30% and not 0.92%. The inflation number is certainly concerning, but it is reasonable to see how some of the supply issues leading to higher prices are potentially temporary. However, many of these disruptions will dissipate as economies around the globe open up, post vaccine. In fact, rising prices are one of the most effective ways markets can correct supply and demand imbalances.

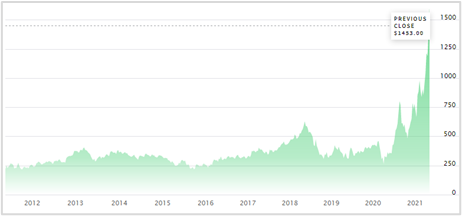

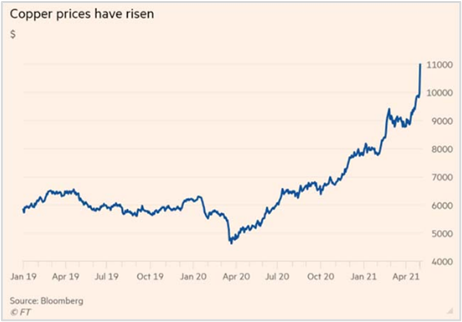

Yet, while many of the supply issues may indeed be transitory, the demand side of the equation is just getting started. For example, the housing market is red hot with demand surging from stimulus and low mortgage rates. Even a casual observer can see how distorted prices are right now, with construction costs absolutely through the roof. Lumber is up nearly 300% year-to-date and at multiples of what were normal ranges (see Chart 2 courtesy of NASDAQ). Copper prices are among economists’ favorite indicators of building costs since it is used widely in construction, and it has nearly doubled pre-COVID levels and is going parabolically higher (Chart 3).

Source: NASDAQ

Source: Bloomberg

So, while the Fed is right about the temporary nature of some supply issues, the demand side of the equation should see a strong tailwind thanks to the combination of fiscal stimulus and a surge in post vaccine spending, especially now that the CDC has removed mask restrictions for vaccinated citizens. The economy could post 8% growth this year with all the stimulus. Nobody believes the Fed’s reiteration that it will be years before rates have to move higher and borrowing costs can rise.

One important difference between bouts of inflation throughout history compared to now is that the Fed believes that they can control inflation if forced to, because they were successful in doing so during the early 1980’s under Chairman Volker’s leadership. The Fed feels that they do not need to start moving preemptively to take the economy down from a boil. We, too, believe that the Fed has the power to control inflation, and therefore we are not expecting a replay of the 1970’s era inflation and borrowing costs in the double digits. We agree that while the Fed can manage the situation, it will be an uncomfortable process for the financial markets, and that is what we are focused on. While the Fed will not take any chances with this recovery, they could be forced to move sooner, faster, and to a larger extent in reducing accommodation, and this is where the risk to the markets lies.

Important Disclosures:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.