The S&P 500 index advanced 8.5% in the third quarter, pushing year to date returns into positive territory, up 5.6% for the year. However, the headline number masks cracks in the markets, as the rally began to run out of steam in September with elevated volatility.

The benchmark declined over 6% from the peak on 9/2 through quarter’s end. Peak to trough (9/2 to 9/23) stocks dropped 9.8%, leaving the Wall Street Journal and Bloomberg wondering what to do with their pre-packaged “stocks decline 10% to correction territory because of (insert headline of the day here)” stories. There certainly are reasons for stocks to be up despite the depression-like pandemic economic data, and yet there are also plenty of reasons to expect a bumpy ride for the remainder of the year. Buckle up for an interesting and lively fourth quarter to come.

The biggest tailwind pushing stocks higher is the stimulus and Fed action to keep interest rates very low for very long and to further manipulate borrowing costs by buying bonds on the open market to provide liquidity and price support. The Fed also put forth a subtle but significant change to their policy mandate going forward by saying, “The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.” What this essentially means is that, going forward, the Fed will not take action (raise rates or reduce QE) based upon predictions; instead they will only act to raise rates and reduce support based on what has already occurred as measured by data that forces them to tighten policy. This is the old “don’t shoot until you see the whites of their eyes” and means that periods like the decline in 2018 when the Fed preemptively began to normalize their policy by raising rates several ticks only to completely reverse course in Q1 2019 will not occur this time around. The consensus estimate now is that the Fed will not raise rates until 2023.

Another tailwind for stocks is continued progress towards a virus vaccine in the near future. There are several candidates that could have approval by year end, and expectations are that there will be mass availability by mid-year 2021. Despite elevated cases and daily death rates in Europe (originally lauded in early Q3 for having slightly better per capita numbers that the US), the numbers in the US have come back down from their “second peak” in July. It goes without saying that a substantial second wave of COVID would become factor #1 and spell trouble for markets and the economy. Given typical virus patterns of increased spread when society moves indoors in colder weather, the fall and winter could see an uptick in cases. The markets focus will be on whether such a second wave would be enough to warrant policies to protect citizens’ health but impair the economy.

Despite wide expectations for approval, the quarter ended without passing the fifth post-coronavirus fiscal stimulus package, as Republicans and Democrats were too far apart to compromise. If inaction persists then a second wave of broad based layoffs and furloughs can be expected, which will weigh on the economic recovery. Up until now, the economic data has been improving. Bright spots include the unemployment rate falling four months in a row and corporate earnings showing resilience and coming in ahead of very low expectations. The economy needs to continue to recover for markets to hang on to gains.

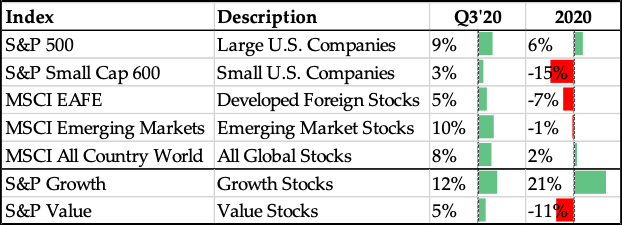

We have written extensively about the disparity between growth and value stocks. As you can see from the opening table, year to date the chasm is very wide, with the S&P Growth index up over 20% for the year, while the S&P Value index is still down more than 11% (although actually up 5% for the quarter) for an incredible 32% performance discrepancy! The outperformance of a concentrated group of stocks that make up a disproportionate part of the indices has been a tailwind to the headline benchmarks, while the average stock has not performed nearly as well as the S&P 500. However these trends do not last forever, and when extreme disparities are reached, reversion becomes more and more overdue. At some point, if the economy is going to continue to recover, then leadership should shift to sectors outside Internet and Biotech to pave the way higher for stocks.

Finally, the coming election is something that is on everyone’s mind and we are asked about it frequently, just as we are during most presidential elections. Of course, we pay close attention to elections and potential economic policies that are enacted afterwards, but we do not try to handicap races and it is important to note that rhetoric often does not become policy. Given how polarized we seem to be as country, the range of potential outcomes seems as wide as ever. It should be noted, however, that the extreme examples of outcomes rarely, if ever, manifest themselves in reality, whether that view be taken from the far right or far left. We can envision positive and negative outcomes under either a Trump or Biden victory. If Trump wins then his low tax, pro-business platform will be welcomed by the markets, but enduring an escalated trade war with China could prove unpleasant for stocks. If Biden wins there will likely be higher taxes for corporations and citizens with high earnings, including potential changes in long term capital gains tax and possible elimination of the step up in basis upon death, but that could be balanced by more fiscal stimulus spending and less overall day to day policy uncertainty, which would be beneficial to the markets. The point is that the extreme examples rarely play out, and we are always focused on long term trends as opposed to how the market will react on a short term basis, which is almost impossible to predict.

Certainly there will be much to write about in the Mid-Quarter Update as well as the Quarterly Summary at the end of the year. In the meanwhile we hope that you all stay safe and well. Please reach out to anyone on our team with any matter at all.

Important Disclosure Information: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. Please remember to contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Grimes is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Sources include: eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics, Bloomberg, FactSet, Morningstar®