The markets have officially shifted gears from inflation to recession being Concern #1.

Only a week or two ago the consensus seemed to be that a soft landing was in the cards. We have been talking about a soft landing for a very long time and mused that the biggest concern was that everyone was on the same side of the boat recently, with similar opinions and positioning. When that happens, it does not take much of a wave to rock the boat. It seems that some well-timed waves have come early in the third quarter, in the form of weaker economic data. Stock prices have declined, resulting in a dash of fear taking over for greed with investors.

The Fed has rightly been vigilant in fighting inflation, keeping interest rates high after the inflationary uptick during the first quarter. The goal is a soft landing – slowing the economy enough to break inflation but not enough to cause a recession, historically a difficult task. The inflation measures have eased during the second quarter, and the economic growth measures are strong (2.8% Q2 GDP versus 1.4% Q1). The concern is that some recent, more forward-looking indicators are weaker than anticipated, and the employment situation has worsened. Economic surveys of manufacturing (PMI and ISM) have been hovering at levels in line with slower than average growth. On Friday 8/2 a softer than expected jobs report was released, a report the Fed probably wishes they had two days earlier at their July meeting when they decided to stand pat on policy. Payrolls were weaker than expected, the May and June statistics were revised lower, and the unemployment rate rose two tenths to 4.3%. While on the softer side, both the manufacturing surveys and the labor report are still well with the “soft landing” range of data, although they introduce recession to the chat as something that is on the table for discussion.

Up until this point, weak data was welcomed as a sign of modest economic slowdown and a taming of inflation. Now, suddenly weak data is taken as a warning of recession. Ten-year Treasury yields dropped from 4.2% to 3.8% on the week, a very substantial move, and market expectations are now for large 50 basis point (0.5%) rate cuts in both September and December. I even heard one analyst, who shall remain nameless, postulate that the Fed will need to have an emergency meeting to cut rates since the next is not until six weeks from now, which at this point is a ridiculous notion. That said, let’s look at this from a couple of angles.

Have we learned nothing over the past fifteen years? Stimulating the economy is no problem for the Fed. A global pandemic that shut down the global economy for a year could not overwhelm the stimulus brought by central banks. Between emergency action, open market purchases of securities, QE, and capital injections, the Fed sure knows how to buoy markets. All should be fine if inflation continues to subside because without that roadblock the Fed can push the gas pedal for the economy. That could be a big “if”, especially if something were to happen with supply chains again (geopolitical problems with China). Another fly in the ointment is that upward pressure on bond yields could occur if concerns about the debt and deficit ever come home to roost.

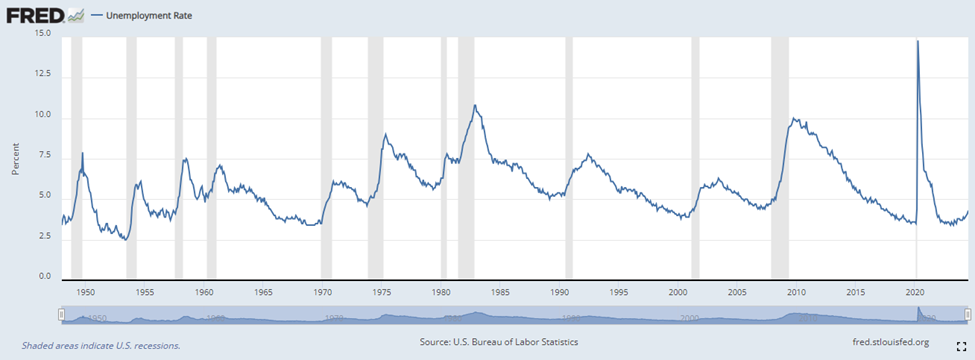

Recessions tend to sneak up on economies. While the level of unemployment is low by historical standards at 4.3%, this is not uncommon historically shortly before recessions have hit. You can see this from the long-term chart of the unemployment rate from the St. Louis FRED website that also shows recessionary periods in the grey regions. Sharp rises from low levels are a precursor for recession.

That said, we all need to keep perspective. Economic statistics are jumpy. The road to a soft landing, if there is one, could be volatile, with periods of recessionary concern and then other periods of worry about an inflation resurgence. That is exactly what has been happening this year. Inflation as Concern #1 in the first quarter, and recession taking the top spot now. We are certainly not giving up on a soft landing yet, but the market could be right to start to price in some potential for recession. At the very least, stock price corrections are normal and expected. They happen, on average, about once per year. There was a correction last year in October, in what was still a strong year. A correction now still leaves markets in positive positions for the year and could provide an opportunity for long-term investors. Whether this is a quick dip in prices, or the beginning of something more nefarious for the economy, nobody knows yet, but we continue to measure and monitor, ready to position portfolios in an effort to provide the best long-term investment experience possible for our clients.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.