Clients and regular readers of this blog are probably tired of hearing that we think rates are likely to be higher for longer, despite many talking heads with the opposite opinion and several periods of dramatic mispricing in the bond market this year. As I have written all year, starting with “Soft Landing and Low Rates are not Compatible” in December 2022, followed by “Beware the Strong Economy” in February, and “Is it time for the Markets to price in “Higher for Longer” again?” in May, the market will not have its cake and eat it, too – meaning a soft landing for the economy and getting the rate cuts that strategists yearn for. If the economy is going to hang tough, then rates will likely stay high.

The economy has been very resilient, especially when you consider that Wall Street consensus last year at this time was for a recession early in 2023. In the past several weeks, the Citi US Economic Surprise Index has neared the best levels since March 2021, and the Atlanta Fed’s GDPNow model is forecasting a 5.8% expansion in Q3, up from an initial estimate of 3.5% in late July. Economic numbers are jumpy, and these measures are likely overstating the economic fortitude here in the US, but strong growth means the Fed is much less likely to start cutting rates due to recession because there is no recession right now.

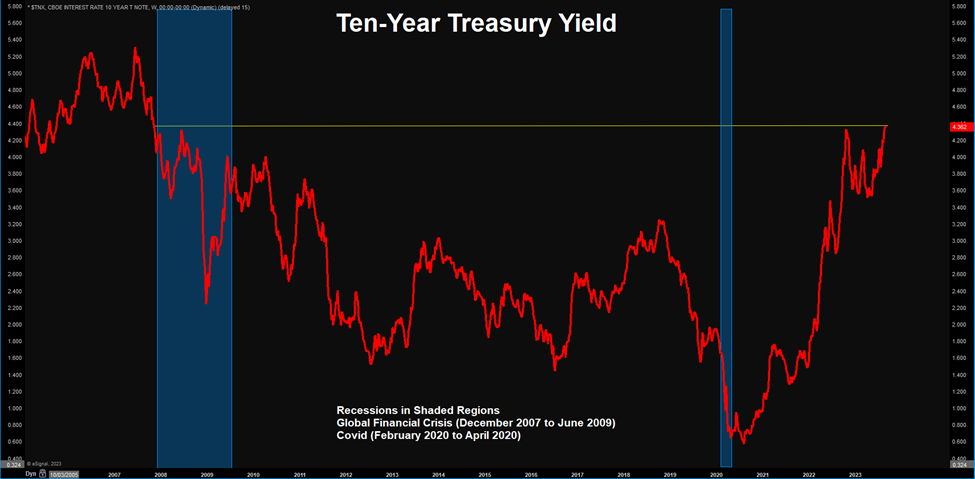

The bond market reacted strongly, with yields surging from a low of 3.29% in April to 4.34% recently – the highest yields since 2007, before the Global Financial Crisis (see chart). Rising yields mean declining prices, and the total return of the Bloomberg Aggregate bond index is now negative for the year after declining 13% last year and 1.7% in 2021. While we expect the yield will likely overcome price pressure between now and the end of the year, the bond index has never had three negative years in a row.

Can you imagine if CNBC reported on the bond market with the same ferocity as stocks? This has been the worst bond market ever. However, bonds are looking more and more attractive as yields rise and prices fall, and these are the most compelling yields in over fifteen years!

Chart 1: US 10 Year Treasury Yield, S&P 500 Index

(Source: FactSet)

So, the big question becomes, “What is next?”. We certainly do not know the answer to that question. Obviously, the Wall Street fixed income experts who were pounding the table to buy bonds, increase duration, and position for lower rates earlier this year at far higher prices have no idea what is to come either. That said, I think history will show that the unusual anomalistic period is not right now but instead was the past fifteen years post-Global Financial Crisis, with very low inflation and growth, allowing Fed policy to focus exclusively on avoiding recession and maintaining full employment. The “new normal” may look more like the “old normal” before the Global Financial Crisis, when the Fed had to balance fighting inflation with smoothing out recessions.

Higher for longer does not mean that there is no pivot in policy and that the Fed will not eventually cut rates. At this point, it means that rates could stay relatively high for a lot longer than most people think, and when the rate cuts do occur, it will be to the 3% range, not zero. A recent report issued by Goldman Sachs makes a lot of sense and is relatively in line with our thinking. They feel the Fed could start with a cut of 25bps as early as Q2 2024, with about one cut per quarter thereafter until Fed Funds stabilizes in the 3 to 3.25% range. I think there is upside risk to all those assumptions, meaning rates could go higher and that the first cut could be further out than Q2 2024. That said, Goldman’s outlook seems reasonable and consistent with longer bond yields in the 4-5% range.

There are plenty of fancy models to determine what benchmark Treasury yields should be. Our simple model: take expected inflation (2-2.5%) and expected real economic growth (2-2.5%) and add them together. This produces a target yield between 4% and 5%, with upside potential if the economy is stronger. Presently, the Ten-Year Treasury is at 4.33%, having finally climbed into the low end of the range, which is quite reasonable and should not be surprising. What did not make sense was the 3.3% at the beginning of the year and in April, after the mini-banking crisis was contained.

Those expecting interest rates to decline back to their post GFC lows may be sorely disappointed, since growth and inflation have held up at levels suggesting rates could stay elevated for some time.

Important Disclosures:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics and FactSet.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.