There is a lot going on under the hood in the markets these days. While the S&P 500 is up a hearty 8% year-to-date, the overall story is not as optimistic. The year-to-date return is driven exclusively by big technology companies such as Apple, Facebook, Google, and Microsoft, and more stocks have negative returns than positive returns so far this year. The Russell 2000 Index, which tracks smaller companies, is under water for the year, and even the S&P 500 Equal Weight index (which does not reward larger companies with bigger weightings in the index) is in the red as of this writing. Bonds have done well so far this year, with the Bloomberg Aggregate up almost 3%. The common thread here is that interest rates have declined overall in 2023, and many expect rate cuts soon.

As I have written about several times now, a simplified set of expectations on what to expect from the market and economy is as follows. In one corner you have the recession scenario, where a weakening economy reduces the inflation threat, and the Fed can lower rates to stimulate. In the other corner you have a resilient economy with lingering inflation, and higher rates for longer as a result. A resilient economy accompanied by rate cuts is just not a likely scenario. Yet the markets, ever so optimistic after a decade of near-zero interest rates and QE, are saying otherwise. Stocks are clearly optimistic, with the S&P 500 at a hefty PE multiple of nearly 19x (based on a $220 per share earnings estimate), and with the 10-year Treasury yield at 3.6% (severely inverted to Fed Funds at 5%), the bond market is screaming for rate cuts. Something has to give.

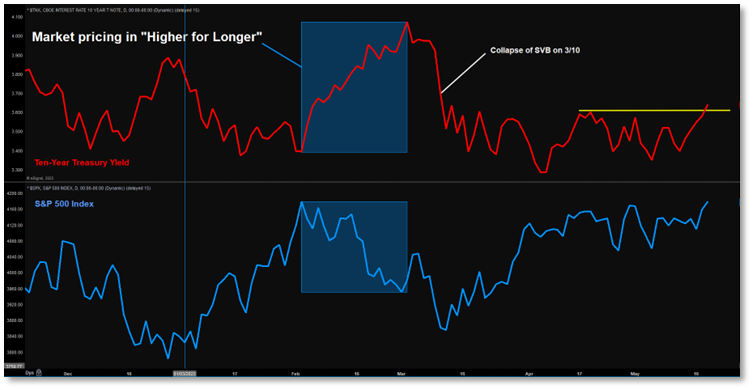

There is no shortage of outlooks and predictions these days. J.P. Morgan’s Chief Investment Officer for Fixed Income came out recently with a warning that recession is “inevitable”, and that the Fed could be cutting rates in response as early as the third quarter of this year. On the exact same day, the Atlanta Fed’s GDP Now Q2 estimate, which measures economic growth based on the most recent data available, rose to 2.9%. It is quite likely that the Fed will be revising their 2023 GDP estimate higher from the current level of only 0.4% very soon. Instead of an imminent recession, it certainly feels to us that the Fed may be right and that the market will need to start pricing “higher for longer” interest rates like it did in February (see shaded region in the accompanying Chart of the yield on the 10-Year Treasury in red and the S&P 500 in blue) before the mini-banking crisis, ignited by the collapse of Silicon Valley Bank on March 10. “Higher for longer” does not necessarily mean that rates need to go much higher from here but that they will stay elevated for a longer period of time than what many people think.

Chart 1: US 10 Year Treasury Yield, S&P 500 Index

(FactSet)

Inflation is still the beast to slay. The number has come down nicely to the current 5% level and is likely to continue lower. However, starting in July, the year ago base levels will become much harder to compare to and we may see inflation settle in the 3% range with the potential to rise again. This supports the “higher for longer” outlook.

The biggest potential source of short-term market turmoil is not raising the debt ceiling. While likely a non-issue in the long run, debt ceiling standoffs are ugly and unpleasant experiences. Trying to trade around or ahead of these events is basically impossible and not something we would recommend. As of this writing it seems that there may be a resolution before the final hour, and that would certainly be a big relief. Eliminating an exogenous shock risk is no doubt a big plus, but perhaps putting the debt ceiling in the rear-view mirror may bring swifter focus to “higher for longer” interest rates. Easy capital market conditions are conducive to inflation and higher interest rates. Another consideration is highlighted in the May 18 Bloomberg article “Wall Street Fears $1 Trillion Aftershock from Debt Deal”, making the point that as the Treasury raises money after draining reserves to push out the debt ceiling deadline, there will be a huge amount of bonds issued, draining capital from the system, and putting upward pressure on bond yields. As you can see from the yellow line in the Chart, yields may be breaking higher from the post banking crisis range. Stay tuned for more on the markets adjusting for “higher for longer” in the coming weeks and months.

Important Disclosure Information:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics and FactSet.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://www.grimesco.com/form-crs-adv/. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.