These days the “Goldilocks” economic scenario is a “soft landing”, a favorite market euphemism for a mild economic slowdown instead of a full-blown recession, accompanied by a rapid decline in inflation. This scenario, with the economy “not too hot and not too cold” (just as Goldilocks preferred her porridge in the childhood fable), allows for the Fed to stop hiking rates and even start cutting sometime in the not-too-distant future.

The inverted yield curve in the bond market suggests that perhaps the outlier risk is that the economy is weaker (too cold) in the later part of this year, with the potential for an unpleasant recession forcing the Fed to cut rates more substantially. But the recent stronger economic data have some people talking about the opposite, a “no landing” scenario, which assumes minimal economic slowdown in the near term. Be careful what you wish for, because a “no landing” today could lead to a “crash landing” tomorrow if restrictive Fed policy goes further than consensus.

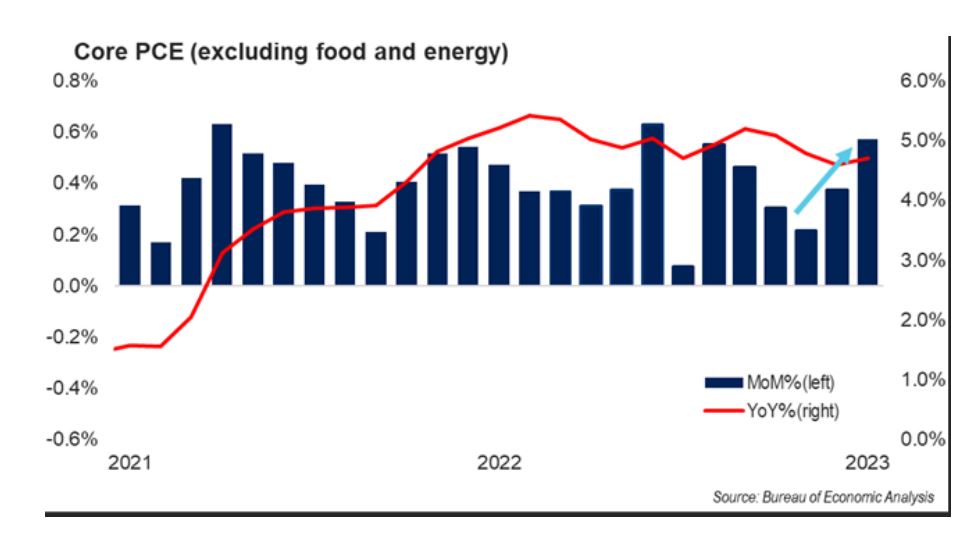

Data in the first quarter point to a robust economy and persistent inflation. The January jobs data released February 3 showed nonfarm payrolls increased by 517,000, dwarfing the 187,000 estimate. According to the JOLTS report, there are nearly two job openings available for every one person looking for work. On February 24, the Personal Consumption Expenditures price index (PCE – see Chart), which is a favored measure of inflation of the Fed, came in spicier than estimates both at the headline level and at the core (excluding food and energy). Consumption, spending and wages thus far in early 2023 show a strong economy and renewed concerns about inflation, and talk from the Fed has become more hawkish as well, even with hints of a possible 50 basis point rate hike in March. Beyond that, corporate earnings have held up much better than many feared. The bond markets have certainly noticed with 10Yr Treasury yields on the move from 3.39% on 2/2 to just under 4% as of this writing only three weeks later.

These days investors must beware an economy that is too hot. It has been so long since we have experienced anything resembling a “normal” business cycle. With inflation in the equation, an economy’s strength and resilience can ultimately prove to be its undoing. There is an old Wall Street saying that says that “an economy does not die on its own”. What that means is that recessions do not usually just occur, they are the product of tighter monetary policy. Economic strength means that inflation remains a concern, which means that the Fed could be forced to raise borrowing costs much higher and for longer than anyone is talking about right now. Nobody is even thinking about 6% Fed Funds rate or more aggressive Quantitative Tightening, but remember that if forced to choose between taming inflation or preventing recession, the Fed will choose the former. The Fed has been warning the markets that taming inflation is job #1, but many have ignored the caution trying to get ahead of a Fed pivot. There is another saying that is probably the truest advice on Wall Street: “Don’t Fight the Fed”, and in today’s world the Fed does NOT want to see high stock markets, excessively low unemployment, and strong economic activity because those conditions allow inflationary forces to build.

The odds probably still favor a “soft landing”, but risks remain on both sides for an economy that is too hot or too cold. Volatility, as the markets adjust to ever changing data, could give investors opportunity. Stay tuned.

Important Disclosures:

Sources include eSignal.com, Bureau of Economic Analysis, Bureau of Labor Statistics and FactSet. Not a substitute for tax or legal advice.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. Grimes is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.grimesco.com. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.