Thus far, 2022 has been a rollercoaster for markets. After dropping 12% year-to-date through mid-March and then rallying over 11% in the final two weeks of the first quarter, the S&P 500 experienced another swift decline, currently down over 15% for the year. Bonds have been no safe haven, with the Bloomberg Aggregate bond index down nearly 10% year-to-date after dropping 1.5% in 2021. Inflation is running at the highest rate in over 40 years, printing at 8.3% in the April release, and the markets have reacted violently to expectations that the Fed will do what needs to be done to contain the threat, even if it means pushing the economy into recession.

Two-year treasury yields are at 2.5%, while Fed funds rates currently stand at only 75 basis points, reflecting the market’s expectation that the Fed raises rates by 50 bps in June and July, and continues with 25 bps moves in the subsequent two or three meetings. The Fed’s forward guidance is a powerful tool (see “The Power of Words”) and, in this case, a full year’s worth of aggressive rate hikes has been priced into the market in the first quarter. Will that be enough, or will inflation prove to be more persistent, requiring even tighter monetary policy than what is already priced in? If that is the case, then that increases the likelihood of a nasty recession on the other side of this inflation wall. But what if inflation does subside a bit? What if China steps back from its supply chain entangling pursuit of zero-covid and starts producing? That could mean that the Fed signals they may not need to tighten the screws on the economy so much after all. Perhaps we have a soft landing in that scenario, and the markets would likely reply with plenty of cheer.

The market will take its cues from the Fed. The Fed will take its cues from incoming data to update guidance on their future policy. The path for 2022 Fed policy is already written, and we are in a holding pattern until more data is available to gauge a true trend on the economy as distortions from the Covid economic freeze move further into the rearview mirror. At this point, trying to predict the future is an exercise in futility. Guessing what Putin’s next move is, or when China might emerge from unreasonable lockdown policies, or what any other factor contributing to inflation levels in 2023 will be, is unknowable. We are in an air pocket. The information we all need to determine the best possible course of action will likely be available to us months into the future. Markets hate uncertainty, and the present holding pattern is generating volatility not seen in years. Investing these days is not pleasant, but the seeds of opportunity are being sown for the first time in a long time.

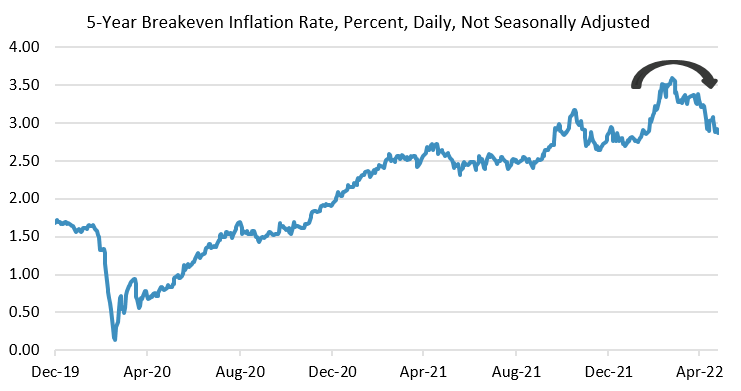

The breakeven inflation rate represents a measure of expected inflation derived from 5-Year Treasury Constant Maturity Securities (BC_5YEAR) and 5-Year Treasury Inflation-Indexed Constant Maturity Securities (TC_5YEAR). The latest value implies what market participants expect inflation to be in the next 5 years, on average. Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department.

(Source: FRED, Federal Reserve Board of Governors, US)

https://fred.stlouisfed.org/

We are not in the prediction business. Our method is to measure and react to what is happening in markets using processes and prudence to guide our decisions. While we are defensively positioned in tactical allocations, markets could be setting up for reasonable opportunities for investors. The most speculative corners of the markets, like biotechnology, emerging markets, and thematic/disruptive growth stocks, have seen amazing price declines. Bonds are finally back to offering respectable yields to bondholders. After price declines and earnings growth, stock indices are back to “normal” valuations. Another potential bright spot is that the 5-Year Breakeven Inflation Rate, which measures what the markets are pricing in real-time for average inflation over the next five years, has declined to under 3% from over 3.5% in March (see Chart). Could peak inflation be in the rearview mirror? At least we get to enjoy some nice weather before the headlines turn to mid-term elections. Maybe by that point there will be additional clarity to the direction of supply chains, input prices, and inflation, and maybe the winds of change will be in the air again, ringing the bell to capitalize on opportunity.

Important Disclosure Information:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Grimes is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Grimes’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.grimesco.com. Please Note: Grimes does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Grimes’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.