Shifting expectations on Federal Reserve policy has been a major market driver in 2024. Because of this, analysts and market coverage spend considerable time and effort trying to predict the Fed’s next move, seemingly on the release of every data point, which has driven interest rate volatility. This quarter, interest rates dropped below 4% at the start of August, as the market was surprised by a weaker than expected unemployment report, and the question was whether the markets had once again gotten ahead of themselves.

Rather than speculate about the direction of Fed policy, we look at what type of economy and Fed policy is priced into the markets, then gauge if that is reasonable. Assuming 2% inflation and 2% trend growth (the Fed’s two long term assumptions), we get a 4% neutral interest rate, bracketed by a 50 bps 3.75% to 4.25% neutral range. Second, we look at the 2yr yield as a proxy for Fed policy, and the 10yr yield as a proxy for the economy. Based on where the 2yr is relative to our neutral range, we can gauge the market’s view of Fed policy, while the 10yr shows what type of economy the market is pricing.

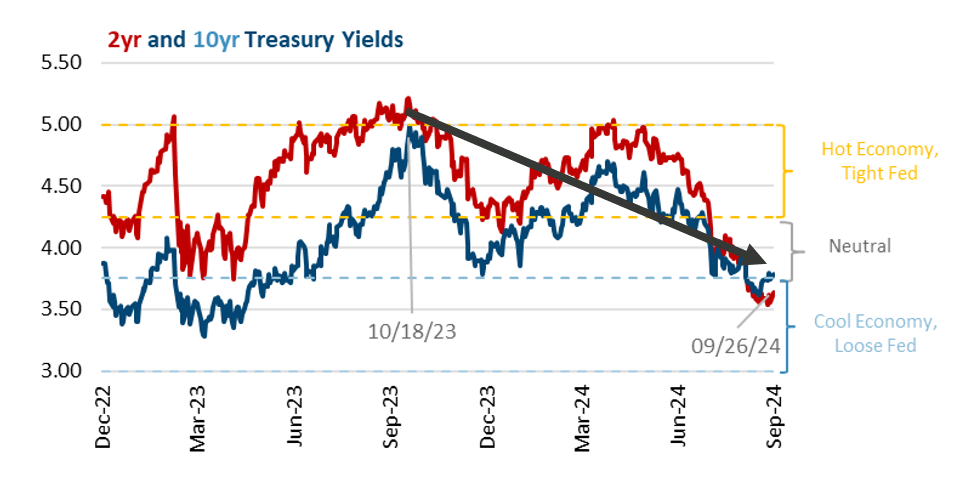

Chart 1 shows these two rates, as well as an orange “Hot Economy, Tight Fed” range of 4.25% to 5.00%, and a blue “Cool Economy, Loose Fed” range of 3.00% to 3.75%.

Chart 1

Periods such as October 2023 and April 2024 saw the markets pricing both a hot economy and tight Fed. Between these two highs, there is the low of December 2023, when markets were pricing a slowing economy and 6 or 7 rate cuts by the Fed in 2024.

While market commentary centered on the economy over-heating (October 2023 and April 2024) or risking recession (December 2023), this framework offered some perspective. The October 2023 peak in rates was correct to price a strong economy and tight Fed policy. However, the drop to December 2023 went too far, too fast on pricing 6 or 7 25 bps Fed rate cuts in 2024, even as the Fed (and the economic data) still suggested three. This was then followed by the rise to April 2024 as a modest uptick in the economic data sent rates too far in the opposite direction. But as of today, with the Fed starting to cut rates, current interest rates are within a reasonable range. Rather than the volatile up and down of the rates swinging around this range, you could have drawn a line from that October 2023 high to rates today and had a much less volatile market.

Further supporting the logic of the current interest rate level, since the Fed’s 50 bps rate cut on 9/18, the 10yr has actually risen while the 2yr has stayed steady. This apparent paradox (the 10yr rising as the Fed cuts rates) is sensible because the Fed’s rate cut was larger than expected, spurring hopes that rather than being behind the curve on the slowing economy (as feared in August), it still has a decent chance of delivering a “soft landing”. It makes sense for the 2yr at 3.64% to be in the blue “Loose Fed” range, while at the same time a “soft landing” would suggest the 10yr should be staying in its neutral range, between 3.75% and 4.25%. The 10yr closed Q3’24 at 3.79%, at the very low end of this envelope. Therefore, bond markets at the end of Q3’24 reflect a reasonable “soft landing” scenario.

The one caveat is that with rates at the low end of the soft landing range, it will be hard for bonds to generate further positive price returns from duration without a recession to push long term rates lower and/or accelerate the expected pace of rate cuts by the Fed. Conversely, if the economy strengthens or inflation becomes a concern, then interest rates would have to adjust higher.

For now, though, current levels are reasonable. The market has been volatile, as The Market has Taken the Scenic Route to Reach the Fed’s View.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. No amount of prior experience or success should not be construed that a certain level of results or satisfaction if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.grimesco.com. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.

The information contained herein is based upon sources believed to be true and accurate. Sources include: Factset Research Systems Inc., Bureau of Economic Analysis, Bureau of Labor Statistics, Congressional Budget Office, Board of Governors of Federal Reserve System, Fred: Federal Reserve Bank of St. Louis Economic Research, U.S. Department of the Treasury

-The Standard & Poor’s 500 is a market capitalization weighted index of 500 widely held domestic stocks often used as a proxy for the U.S. stock market. The Standard & Poor’s 400 is a market capitalization weighted index of 400 mid cap domestic stocks. The Standard & Poor’s 600 is a market capitalization weighted index of 600 small cap domestic stocks.

-The NASDAQ Composite Index measures the performance of all issues listed in the NASDAQ stock market, except for rights, warrants, units, and convertible debentures.

-The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of 21 emerging markets. The MSCI All Country World Index is a free float adjusted market capitalization index designed to measure the performance of large and mid and cap stocks in 23 developed markets and 24 emerging markets. With over 2,800 constituents it represents over 85% of the global equity market.

-The Barlcays Aggregate Index represents the total return performance (price change and income) of the US bond market, including Government, Agency, Mortgage and Corporate debt.

-The BofA Merrill Lynch Investment Grade and High Yield Indices are compiled by Bank of America / Merrill Lynch from the TRACE bond pricing service and intended to represent the total return performance (price change and income) of investment grade and high yield bonds.

-The S&P/LSTA U.S. Leveraged Loan 100 is designed to reflect the largest facilities in the leveraged loan market. It mirrors the market-weighted performance of the largest institutional leveraged loans based upon market weightings, spreads and interest payments.

-The S&P Municipal Bond Index is a broad, comprehensive, market value-weighted index. The S&P Municipal Bond Index constituents undergo a monthly review and rebalancing, in order to ensure that the Index remains current, while avoiding excessive turnover. The Index is rules based, although the Index Committee reserves the right to exercise discretion, when necessary.

-The BofA Merrill Lynch US Emerging Markets External Sovereign Index tracks the performance of US dollar emerging markets sovereign debt publicly issued in the US and eurobond markets.

-The HFRI Fund of Funds index is compiled by the Hedge Funds Research Institute and is intended to represent the total return performance of the entire hedge fund universe.