2023 has seen an equity market recovery after a challenging 2022, at least when looking at the S&P 500’s 17% ytd return. Beyond the S&P 500, returns are not as robust. The crux of the issue is most evident when comparing the Tech rich NASDAQ (+32% ytd) to the Dow Jones (+5%). It’s not just the case of technology stocks outperforming, but rather that a small group of seven megacap stocks in Technology (Apple, Microsoft and Nvidia), Communications (Alphabet and Meta), and Discretionary (Amazon and Tesla) have driven the majority of market returns. Combined, these 7 stocks are over 27% of the S&P 500’s market cap, led by Apple and Microsoft at about 7% each. Not only are they large but, even though they are spread across sectors, they have the common driver of technology in general and excitement over the prospect of AI (artificial intelligence). And thanks to this investor enthusiasm, the seven stock group carries an average PE of 46, compared to 19 for the S&P 500 overall, and therefore 16 for the remaining 493 stocks. These are, without question, excellent companies. But their impact on the market is exaggerated to the point of distorting the overall market.

Chart 1

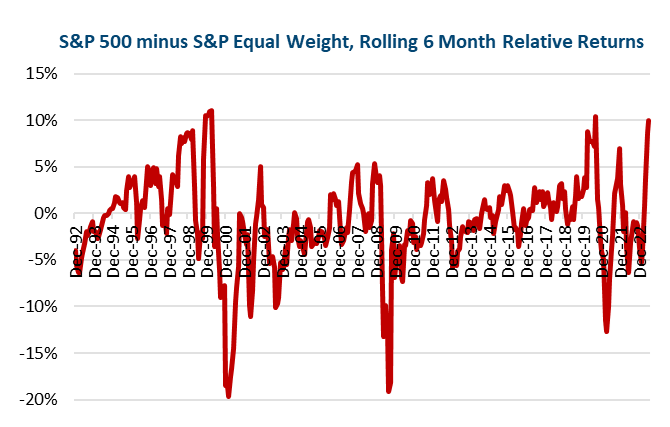

This concentrated market is evident by comparing the S&P 500 (which is capitalization weighted) to the Equal Weight S&P 500 (with the same members, but each has an equal 0.2% contribution). Looking at rolling 6 month returns in the chart to the left, the current gap has reached 10% for only the third time since 1992. The prior instances, which happened in March ’00 and August ’20, offer some insight going forward.

March ’00 was the peak of the dotcom market, paired with a bubble in large cap stocks. The narrow market not only preceded a tech stock decline, but also a 10-year period of retrenchment for the S&P 500 (it did not surpass its March ’00 high until 2007 briefly, then finally in 2013), known at the time as a “lost decade” for large cap US stocks.

The August ’20 narrow market was again led by tech stocks, though this time it was the “stay at home” winners from the early Covid stock market recovery. Unlike March ’00, this did not precede a major market decline. Rather growing optimism of a vaccine-driven recovery spurred a larger, but broader, stock market rally.

What can we learn? Narrow markets do not necessarily mean “bad times are coming”, as the 2020 experience showed. But what they do mean is “be careful chasing the narrow market drivers”. In 2020 tech stocks (especially the “disruptive tech ARK stocks”) led the way but then lagged the broader market in 2021 and 2022. After March ’00, the NASDAQ declined over 70%. Also, while 2000 to 2010 was a lost decade for large cap US stocks, international and small cap stocks outperformed.

The biggest lesson in a narrow market is not to chase the small group of outperformers, but to stay diversified and on plan. This is evident in the chart, as both periods saw a major reversal, with the Equal Weight S&P enjoying subsequent outperformance of 20% (2/28/01, 11 mo after the peak) and 12% (7 mo after the peak, on 3/31/21). This is why Investors Shouldn’t Lose Focus Because of Market Concentration.

Important Disclosures:

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Grimes & Company, Inc. [“Grimes]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Grimes. No amount of prior experience or success should not be construed that a certain level of results or satisfaction if Grimes is engaged, or continues to be engaged, to provide investment advisory services. Grimes is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Grimes’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.grimesco.com. Please Remember: If you are a Grimes client, please contact Grimes, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Grimes account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Grimes accounts; and, (3) a description of each comparative benchmark/index is available upon request.

The information contained herein is based upon sources believed to be true and accurate. Sources include: Factset Research Systems Inc., Bureau of Economic Analysis, Bureau of Labor Statistics, Congressional Budget Office, Board of Governors of Federal Reserve System, Fred: Federal Reserve Bank of St. Louis Economic Research, U.S. Department of the Treasury

-The Standard & Poor’s 500 is a market capitalization weighted index of 500 widely held domestic stocks often used as a proxy for the U.S. stock market. The Standard & Poor’s 400 is a market capitalization weighted index of 400 mid cap domestic stocks. The Standard & Poor’s 600 is a market capitalization weighted index of 600 small cap domestic stocks.

-The NASDAQ Composite Index measures the performance of all issues listed in the NASDAQ stock market, except for rights, warrants, units, and convertible debentures.

-The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of 21 emerging markets. The MSCI All Country World Index is a free float adjusted market capitalization index designed to measure the performance of large and mid and cap stocks in 23 developed markets and 24 emerging markets. With over 2,800 constituents it represents over 85% of the global equity market.

-The Barlcays Aggregate Index represents the total return performance (price change and income) of the US bond market, including Government, Agency, Mortgage and Corporate debt.

-The BofA Merrill Lynch Investment Grade and High Yield Indices are compiled by Bank of America / Merrill Lynch from the TRACE bond pricing service and intended to represent the total return performance (price change and income) of investment grade and high yield bonds.

-The S&P/LSTA U.S. Leveraged Loan 100 is designed to reflect the largest facilities in the leveraged loan market. It mirrors the market-weighted performance of the largest institutional leveraged loans based upon market weightings, spreads and interest payments.

-The S&P Municipal Bond Index is a broad, comprehensive, market value-weighted index. The S&P Municipal Bond Index constituents undergo a monthly review and rebalancing, in order to ensure that the Index remains current, while avoiding excessive turnover. The Index is rules based, although the Index Committee reserves the right to exercise discretion, when necessary.

-The BofA Merrill Lynch US Emerging Markets External Sovereign Index tracks the performance of US dollar emerging markets sovereign debt publicly issued in the US and eurobond markets.

-The HFRI Fund of Funds index is compiled by the Hedge Funds Research Institute and is intended to represent the total return performance of the entire hedge fund universe.